Balance Sheet Transformation Includes Conversion of Over $5.8 Million Debt to Equity

Stockholders’ Equity Improves from Deficit of $2.4 Million to Equity of $4.6 Million

Loss for the Six-Month Period Decreases from $20.0 Million to $8.5 Millon

Miami, FL – August 23, 2023 – Globe Newswire – Smart for Life, Inc. (Nasdaq: SMFL) (“Smart for Life” or the “Company”), a high growth global leader in the Health & Wellness sector marketing and manufacturing nutritional foods and supplements worldwide, today provided a business update and reported financial results for the three months ended June 30, 2023.

“We continue to advance our operations and have made significant progress growing our brands. During the quarter, we launched a new line of Sports Illustrated protein bars. We made these bars to address a growing demand for clean and nutritional products. The bars are non-GMO, cold-pressed, with no sucralose and no preservatives, and include options that are gluten-free. We look forward to launching them in select markets this quarter. Recently, we entered into a distribution agreement with Boxout, a national distributor of medical, rehabilitation, and health & wellness products, for nationwide distribution of our proprietary Sports Illustrated Nutrition products through Boxout’s distribution channels to sports and fitness chains across North America. We look forward to working with Boxout and leveraging their broad distribution network.”

“We also executed a comprehensive Canadian distribution agreement with Two Hands Corporation for our nutritional food products. We expect this agreement to significantly expand our geographic reach by adding additional distribution partners and retail channels in Canada. Expansion of our sales in both domestic and international markets is a key component of our growth strategy as part of our stated goal of reaching $100 million in revenue. Although our revenues decreased in Q2 2023, due to cash constraints and fulfillment delays, we are confident that as we execute on the growing sales pipeline and purchase orders, our sales should rapidly increase. Notably, during the quarter, we enhanced our balance sheet, by converting over $5.8 million of debt to equity. We also converted $1.2 million of deferred executive and board compensation to equity as well.”

“We continue to execute on our “Buy and Build” strategy by acquiring cash flow positive companies at attractive multiples. Towards that end, we expect to close the eCommerce nutraceuticals company acquisition in the next several weeks. The target is currently generating estimated revenue in excess of $10 million, with over $2 million of EBITDA for the trailing twelve months. Overall, we believe we are well positioned to achieve strong revenue growth and drive significant value for our shareholders.”

Financial Results

Revenue was $2.3 million for the three months ended June 30, 2023, compared to $4.3 million for the three months ended June 30, 2022. The decrease in revenue was primarily due to a delay in financing, which led to a temporary delay in production. Gross profit was approximately $742 thousand for the three months ended June 30, 2023, compared to $1.8 million for the same period last year. Net loss attributable to common shareholders was $4.2 million for the three months ended June 30, 2023, as compared to $3.5 million for the three months ended June 30, 2022.

Revenue was $4.7 million for the six months ended June 30, 2023 compared to $8.7 million for the six months ended June 30, 2022. Gross profit was $1.6 million for the six months ended June 30, 2023 compared to $3.3 million for same period last year. Net loss attributable to common shareholders was $8.5 million for the six months ended June 30, 2023 compared to $20.2 million for same period last year.

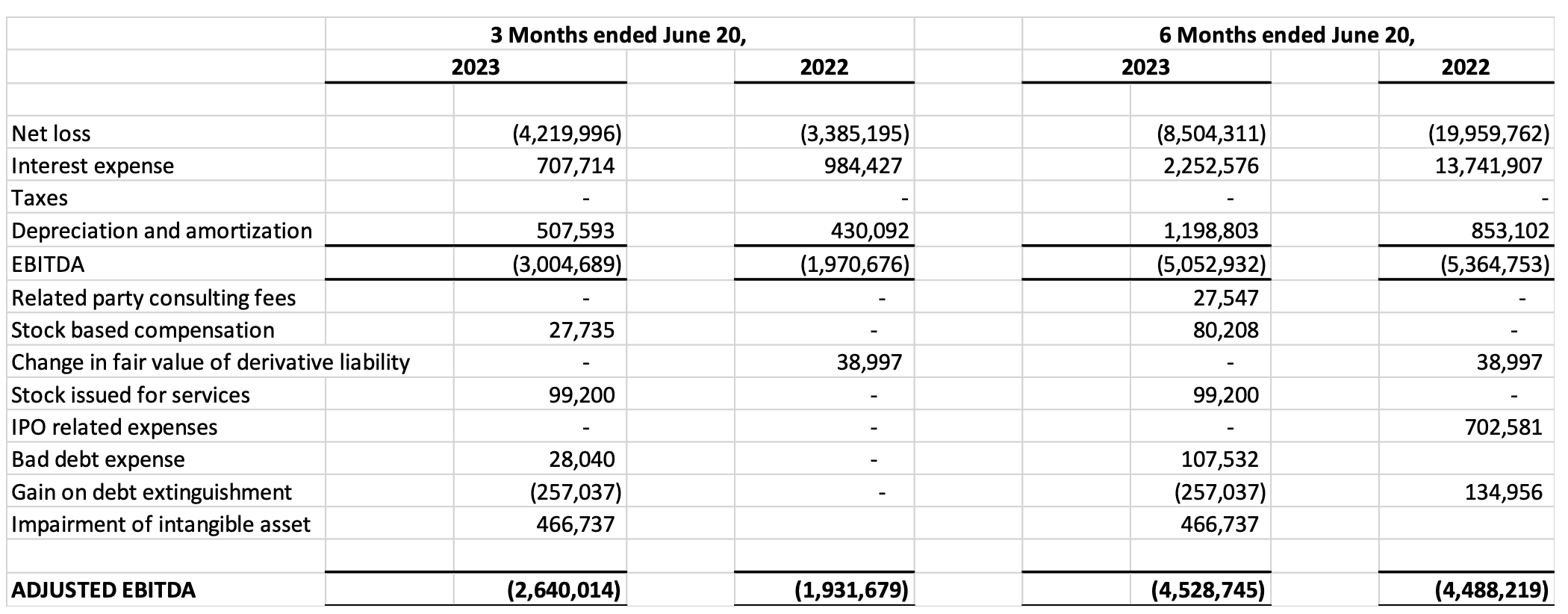

EBITDA and Adjusted EBITDA

The Company reported Adjusted EBITDA loss of $2.6 million in Q2 2023, as compared to Adjusted EBITDA loss of $1.9 million in Q2 2022. For the six months ended June 30, 2023, the Company reported Adjusted EBITDA loss of $4.5 million versus an Adjusted EBITDA loss of $4.5 million for the same period last year. The Company defines EBITDA as earnings before interest, taxes and depreciation and amortization. The Company defines Adjusted EBITDA as earnings before related party consulting fees, stock-based compensation, stock issued for services, bad debt expense, IPO related expenses, impairment of intangible assets, and gain on debt extinguishment. Both EBITDA and Adjusted EBITDA are not measures of performance calculated in accordance with Generally Accepted Accounting Principles in the United States of America (“GAAP”), and should not be considered in isolation of, or as a substitute for, earnings as an indicator of operating performance or cash flows from operating activities as a measure of liquidity. The Company believes the presentation of EBITDA and Adjusted EBITDA is relevant and useful by enhancing the readers’ ability to understand the Company’s operating performance. The Company’s management utilizes EBITDA and Adjusted EBITDA as means to measure performance. The Company’s measurements of EBITDA and Adjusted EBITDA may not be comparable to similar titled measures reported by other companies. The table below reconciles EBITDA and Adjusted EBITDA, both non-GAAP measures, to GAAP numbers for net loss for net loss for the three and six months ended June 30, 2023 and 2022.

About Smart for Life, Inc.

Smart for Life, Inc. (Nasdaq: SMFL) is engaged in the development, marketing, manufacturing, acquisition, operation and sale of a broad spectrum of nutritional and related products with an emphasis on health and wellness. Structured as a publicly held global holding company, the Company is executing a Buy-and-Build strategy with serial accretive acquisitions creating a vertically integrated company with an objective of aggregating companies generating a minimum of $300 million in revenues by the fourth quarter of 2026. To drive growth and earnings, Smart for Life is developing proprietary products as well as acquiring other profitable companies, encompassing brands, manufacturing and distribution channels. The Company currently operates five subsidiaries including Doctors Scientific Organica, Nexus Offers, Bonne Santé Natural Manufacturing, GSP Nutrition and Ceautamed Worldwide. For more information about Smart for Life, please visit: www.smartforlifecorp.com.

Video regarding the Company’s manufacturing facility at Bonne Santé Natural Manufacturing is available at: www.bonnesantemanufacturing.com/video.

Investor material and a Fact Sheet with additional information about Smart for Life is available at: www.smartforlifecorp.com/investor-center.

Forward-Looking Statements

This press release may contain information about our views of future expectations, plans and prospects that constitute forward-looking statements. All forward-looking statements are based on management’s beliefs, assumptions and expectations of Smart for Life’s future economic performance, taking into account the information currently available to it. These statements are not statements of historical fact. Although Smart for Life believes the expectations reflected in such forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained. Smart for Life does not undertake any duty to update any statements contained herein (including any forward-looking statements), except as required by law. No assurances can be made that Smart for Life will successfully acquire its acquisition targets. Forward-looking statements are subject to a number of factors, risks and uncertainties, some of which are not currently known to us, that may cause Smart for Life’s actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial position. Actual results may differ materially from the expectations discussed in forward-looking statements. Factors that could cause actual results to differ materially from expectations include general industry considerations, regulatory changes, changes in local or national economic conditions and other risks set forth in “Risk Factors” included in our filings with the Securities and Exchange Commission.

Investor Relations Contact

Crescendo Communications, LLC

Tel: (212) 671-1021

SMFL@crescendo-ir.com